Deliver a seamless start to every financial relationship

Onboarding is one of the most important journeys in financial services. Whether a bank is welcoming private customers, business clients, or partners, the experience needs to be fast, intuitive, and compliant. Many institutions still depend on manual forms, scattered data collection, and long verification cycles that create unnecessary friction for both customers and internal teams. Wizflow helps financial institutions digitise and optimise any onboarding process through guided, user friendly flows that reduce drop offs, increase data accuracy, and ensure that compliance is built in from the first step. Flows can collect structured information, validate inputs, trigger background checks, and adapt dynamically based on customer type or risk level. Below is a simple example based on SME onboarding that illustrates how an onboarding flow can work in practice.How This Flow Works

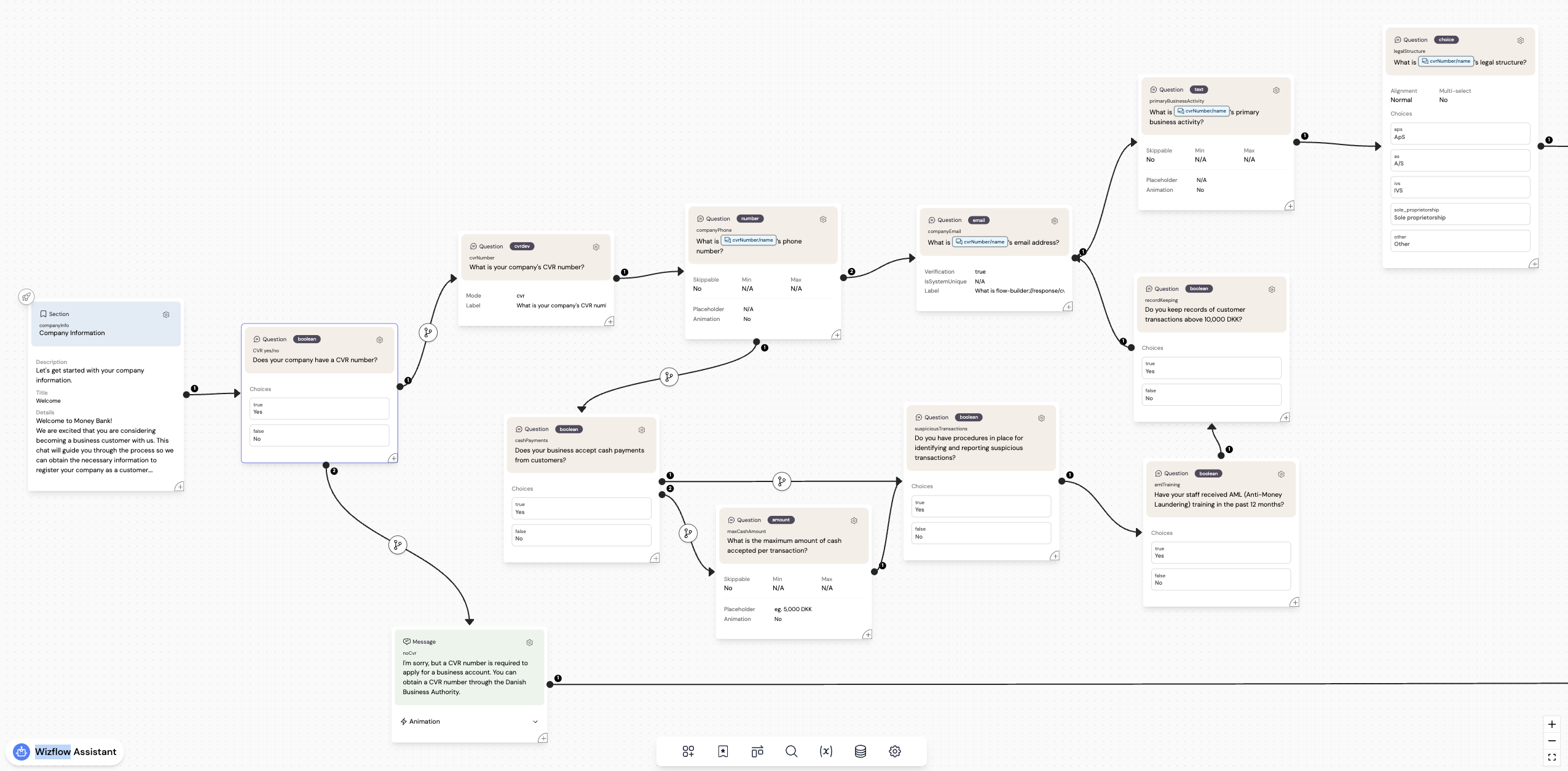

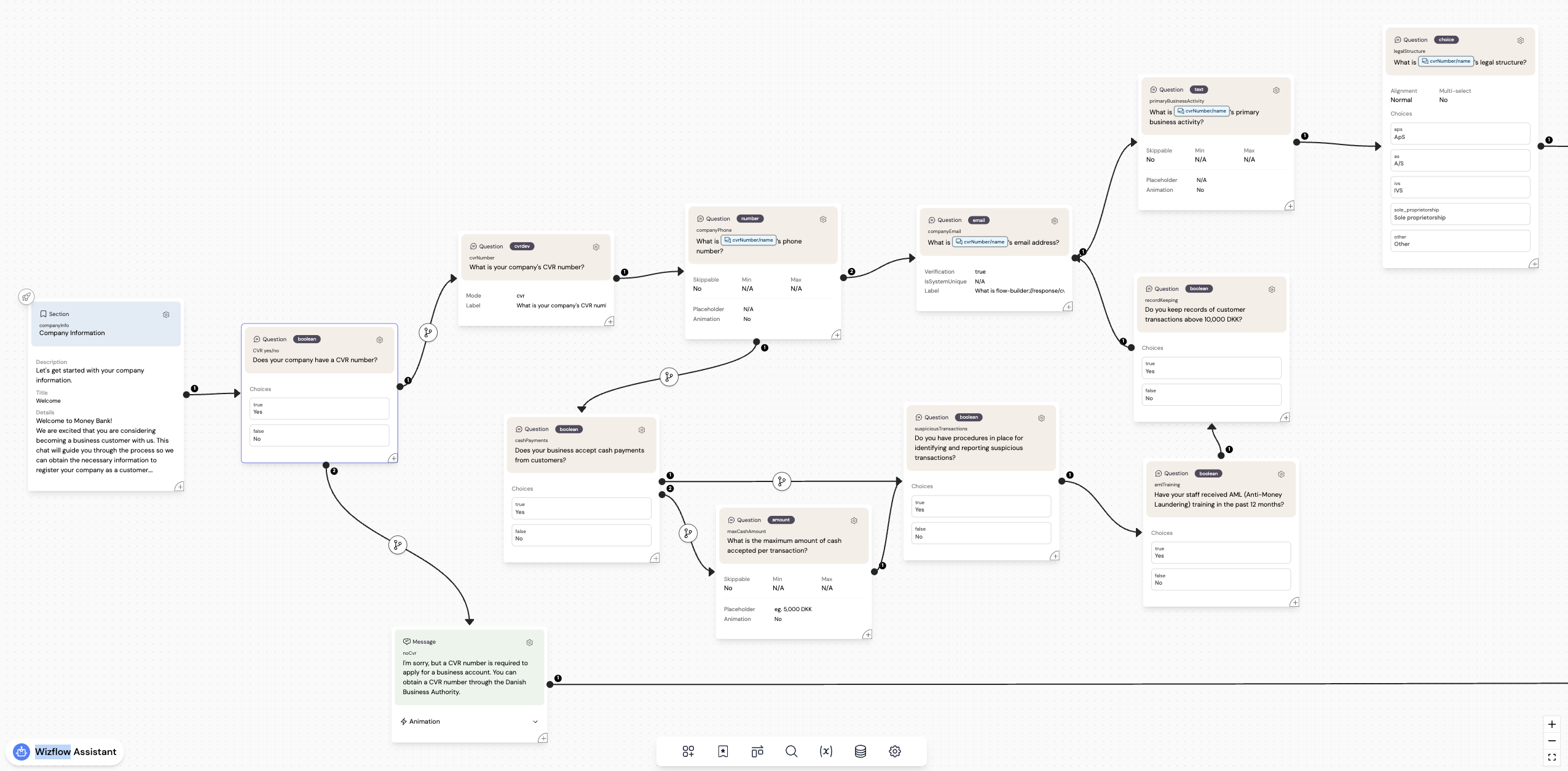

The Money Bank business application flow is designed to guide companies through a structured and compliant onboarding experience. It ensures that all required business, ownership, and regulatory information is collected efficiently while adapting the journey based on the company’s characteristics and risk factors. The result is a streamlined process that reduces manual review time, enforces compliance rules, and gives applicants a clear and intuitive path from start to finish.1. Starting the Application

1. Starting the Application

The flow begins by establishing the company’s identity. Applicants are first asked whether the business has a CVR number. If the business is registered, the applicant enters the CVR, which automatically retrieves official company details. This reduces manual data entry, ensures accuracy, and speeds up the process.If the company does not have a CVR number, the flow displays an informational message explaining that Money Bank can only onboard registered businesses and gracefully ends the conversation.

2. Collecting Key Company Details

2. Collecting Key Company Details

Once a valid CVR is provided, the flow gathers the core business information needed to begin a banking relationship. This includes:

- Company phone number

- Company email address

- Business activities and industry codes (retrieved automatically via the CVR lookup)

3. Conditional Questions Based on Industry

3. Conditional Questions Based on Industry

The flow dynamically adapts to the applicant’s business type. If the company operates in industries that typically handle cash (identified through their industry code), the application asks additional questions about cash acceptance and transaction limits.This ensures that Money Bank gathers the right level of detail for businesses with potential cash-handling risk, while keeping the experience fast and simple for companies where these questions are irrelevant.

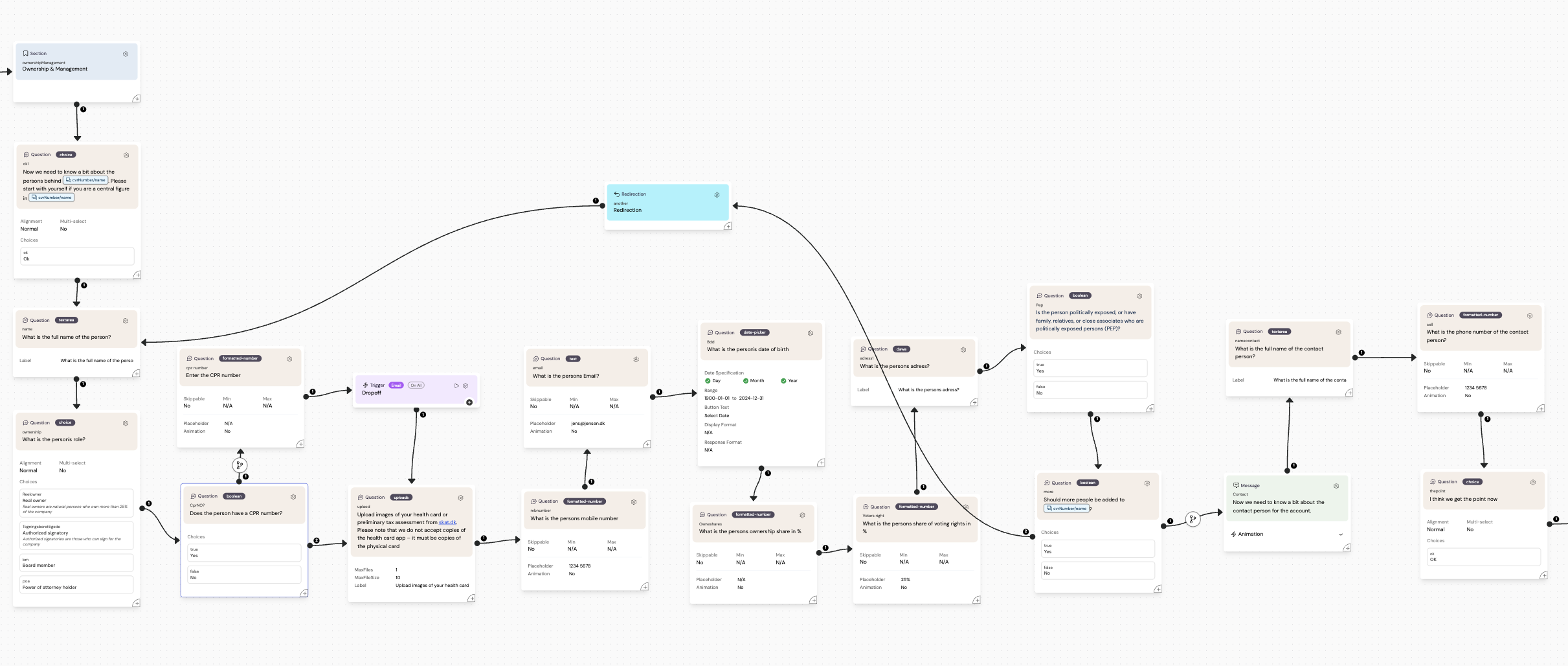

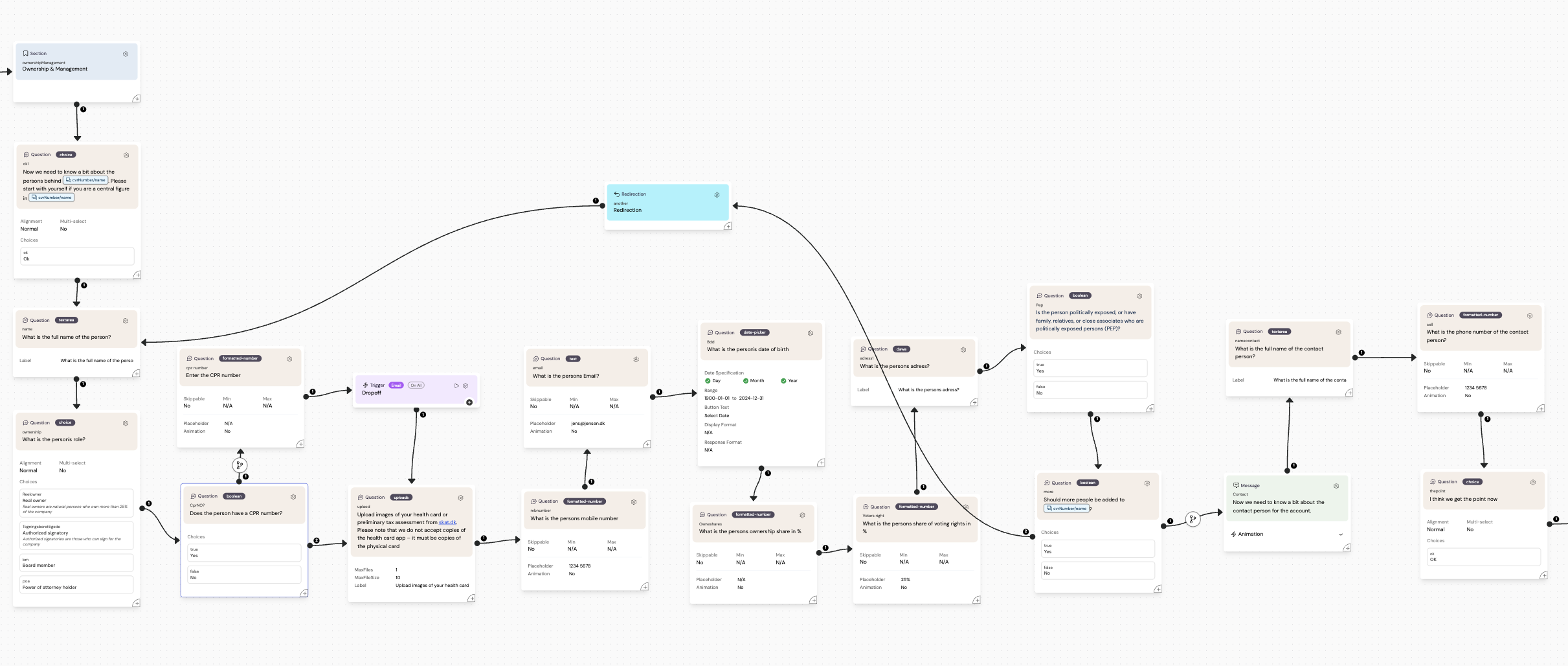

4. Collecting Owners and Signatories

4. Collecting Owners and Signatories

Next, the flow enters an ownership loop that captures information for each beneficial owner or authorised signatory. For every person, the flow collects:

- Full name

- CPR number

- Date of birth

- Ownership percentage

- PEP status

- Tax residency information

5. Handling Compliance Requirements

5. Handling Compliance Requirements

The flow includes smart routing that ensures that compliance-related information is collected only when needed:Tax Residency: If any owner has tax residency outside Denmark, additional details are requested before continuing.PEP Status: Positive PEP responses automatically contribute to the internal risk assessment.Document Uploads: Applicants are prompted to upload Articles of Association, supporting Money Bank’s verification process.Each compliance checkpoint is embedded naturally in the conversation, reducing friction while ensuring all regulatory obligations are met.

6. Automated Risk Profiling

6. Automated Risk Profiling

Behind the scenes, the flow uses a risk assessment variable that automatically calculates the applicant’s risk level based on their answers. Factors such as PEP status, international tax residency, cash acceptance, and international payment needs determine whether the application is categorised as Low, Medium, or High risk.This enables Money Bank to triage applications instantly, speeding up decision-making and ensuring consistency across all cases.

7. Drop-Off Detection and Follow-Up

7. Drop-Off Detection and Follow-Up

To reduce abandoned applications, the flow includes an automated drop-off trigger. If an applicant enters their CPR number but stops before uploading required documents, the system immediately notifies Money Bank’s internal team. This allows fast, proactive outreach and helps recover applications that would otherwise be lost.

8. Final Review and Submission

8. Final Review and Submission

Before finishing, applicants receive a dynamically generated summary that displays all the details they have entered. If corrections are needed, they are guided back to update the relevant information. If everything is correct, the application concludes and is passed to Money Bank for review.All details in the summary are generated automatically through resource interpolation, ensuring accuracy and reducing manual handling.